27 Jan 2025 HSE Job Market Analysis: What a Year!

If you follow us on LinkedIn, you’ll know we regularly track and analyse the health and safety job market. As part of this process, we use data from Australia’s most popular job boards, SEEK and LinkedIn. We then cross-check this data against reports from ABS, SEEK, and other industry specialists. Finally, we triple-cleanse the data.

Unlike other reports, our data is accurate because we only track jobs in the health and safety job family.

Now it’s time to share the 2025 full-year data with you!

The Data Reveal (Drum Roll Please!)

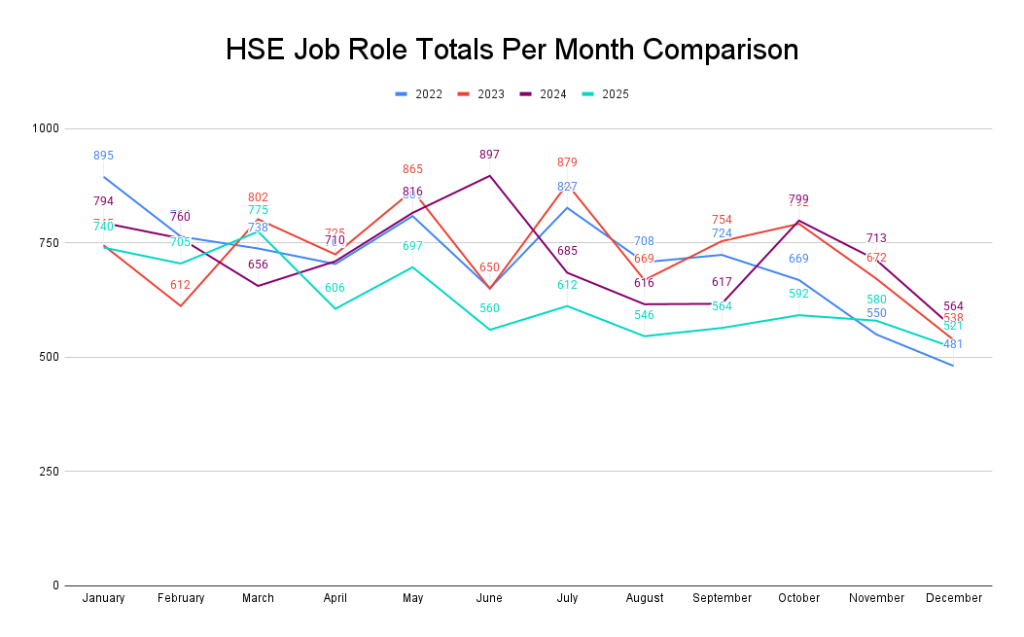

2025 saw a decline in job ad volume compared to 2024 (-13% decrease). Ad volumes began the year from an elevated base in January – May, but steadily decreased from June – December with a few peaks here and there. Applications per job ad remained very high, highlighting strong competition for open roles.

According to SEEK senior economists, January 2025 saw a 5% increase in ad volumes compared to three months of decline in 2024, which marked the highest increase in ad volumes in over three years, which matches our data.

SEEK’s ad volumes also matched our data, which described 2025 as a “tale of two halves.”

“This year has been a tale of two halves – the first six months demonstrated small but important growth after many months of decline, and then, since August, we have seen incremental drops month-on-month.

There was increased activity in the Industrial and Construction sectors, along with pockets of growth in Healthcare & Medical and Retail & Consumer Products. These industries in particular have cooled in recent months, contributing to an overall slowdown as we head into summer.

Applications per job ad, which have also stabilised since mid-year, continue to be elevated, so the market remains very competitive for candidates as job ads slow for the Christmas break.”

The bifurcation of job roles seems to reflect employers’ cautious approach to hiring amid persistent economic uncertainty, geopolitical volatility (particularly US tariff concerns noted by the RBA), and rate-setting expectations.

According to the ABS, unemployment rose to 4.5% in September 2025 (its highest level since late 2021), before falling back to 4.3% in October 2025, where it remained for the rest of the year.

According to Westpac, the Reserve Bank of Australia’s 2025 monetary policy trajectory reversed sharply from hopeful easing to cautious restraint, punctuated by three rate cuts in the first half of the year, followed by a hard hold in the second half and an explicit pivot toward potential rate hikes in 2026, which may have also contributed to the bifurcation of the year.

Inflation is rising as productivity falls, but economic growth is projected to hit 2% in 2026, up from 1.4% in 2025, which will most likely lead to jobs and inflation stabilising.

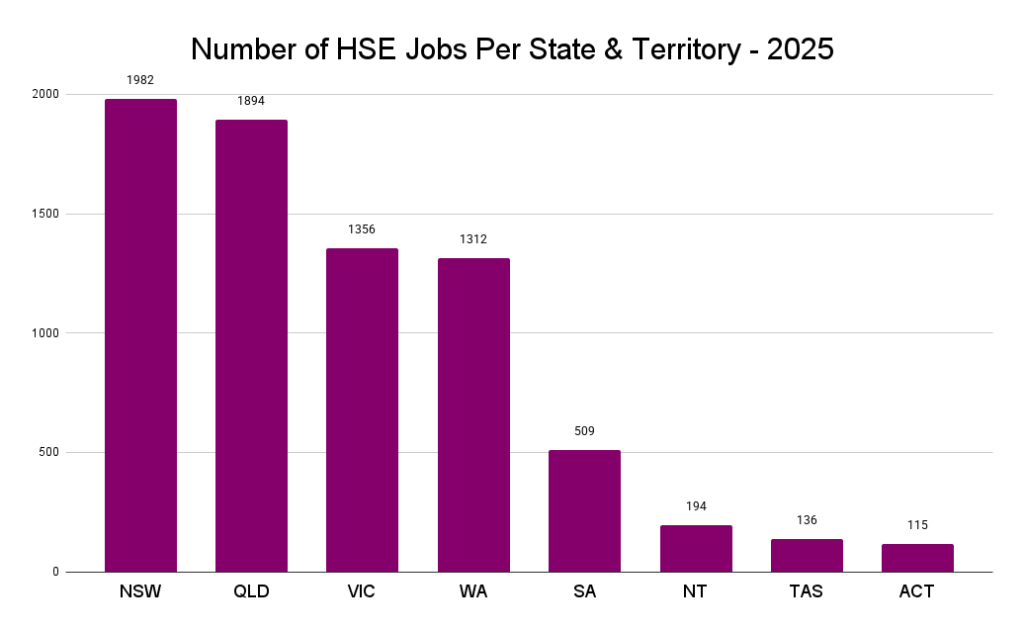

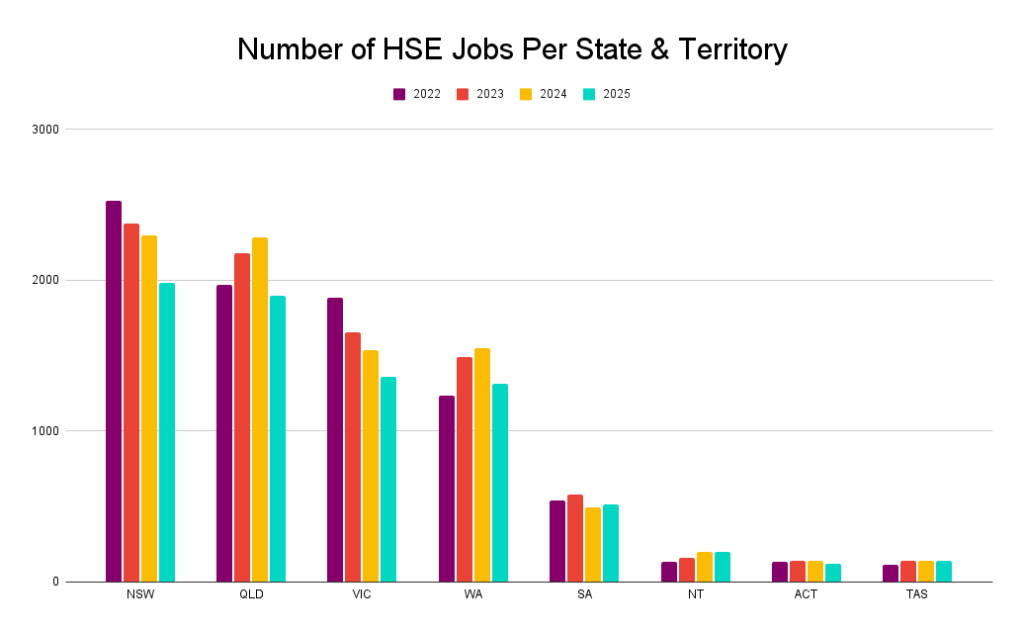

Looking at our data, 7498 roles were advertised in 2025.

Compared with 2022-2024, 2025 saw the fewest HSE roles advertised.

Unpacking the 2025 Health & Safety Job Trends

Where were the jobs?

The majority of health and safety roles were advertised in:

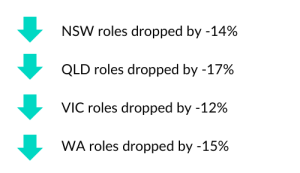

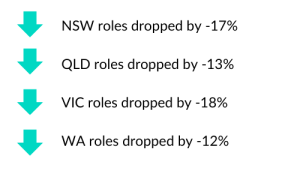

Compared to 2024,

Compared to 2023,

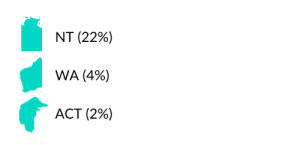

The only growth in roles from 2024 to 2025 was reported in;

- SA up 4%

- With NT and TAS both advertising the same number of roles

South Australia

According to SEEK, singled out as a top performer, South Australia defied the national trend with annual growth in job ads pointing to strong underlying demand in the state, particularly for workers in the industrial and construction sectors. Why? South Australia is hosting major AUKUS defence and advanced manufacturing expansion, particularly at the Osborne shipyard alongside state-wide construction and infrastructure projects.

The most significant growth in roles from 2023 to 2024 was reported in;

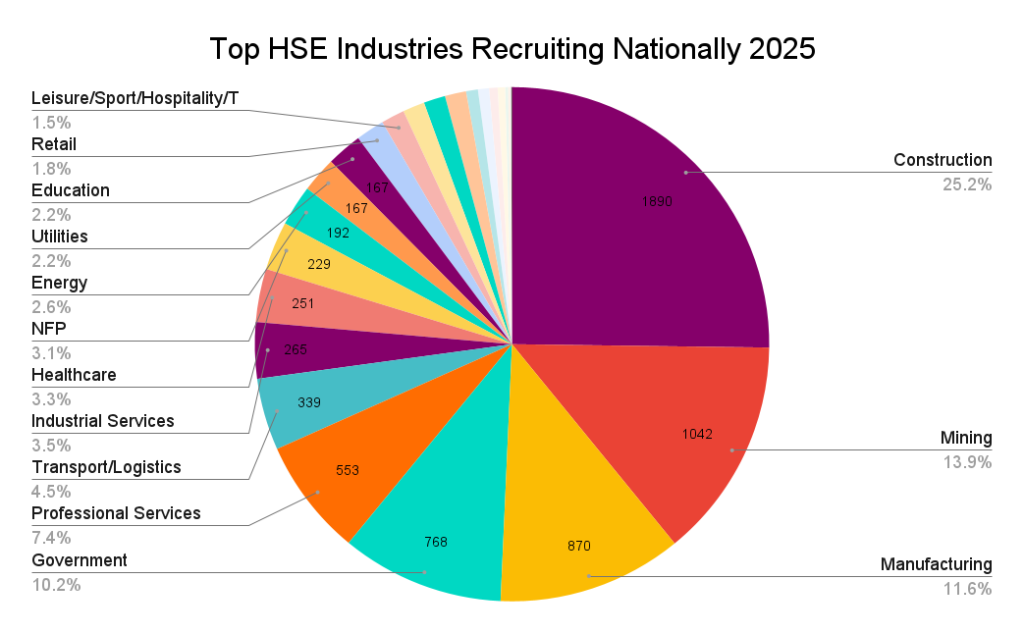

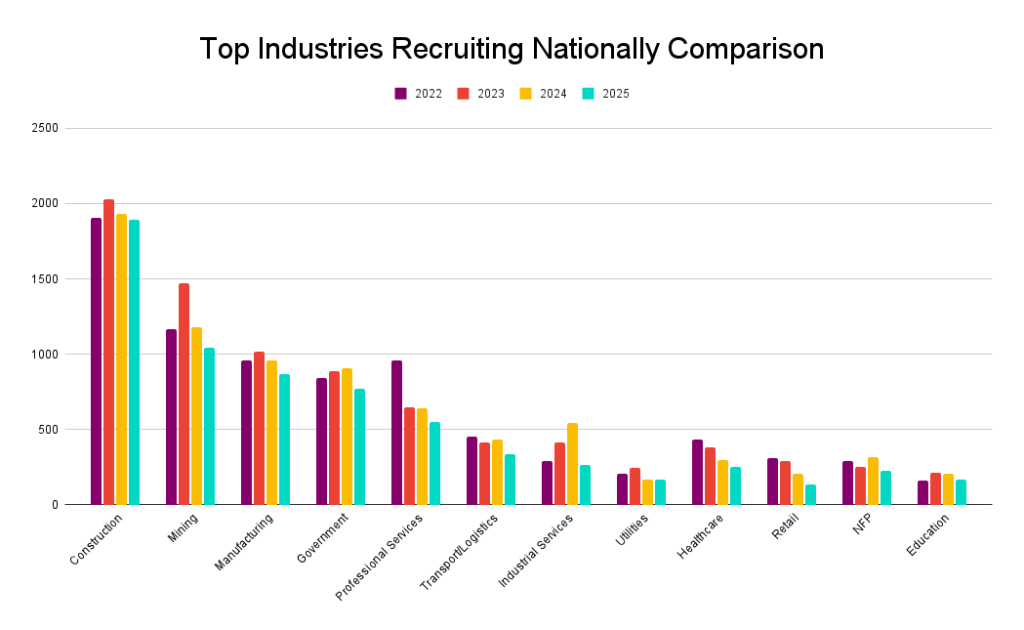

Industries hiring the most HSE professionals were

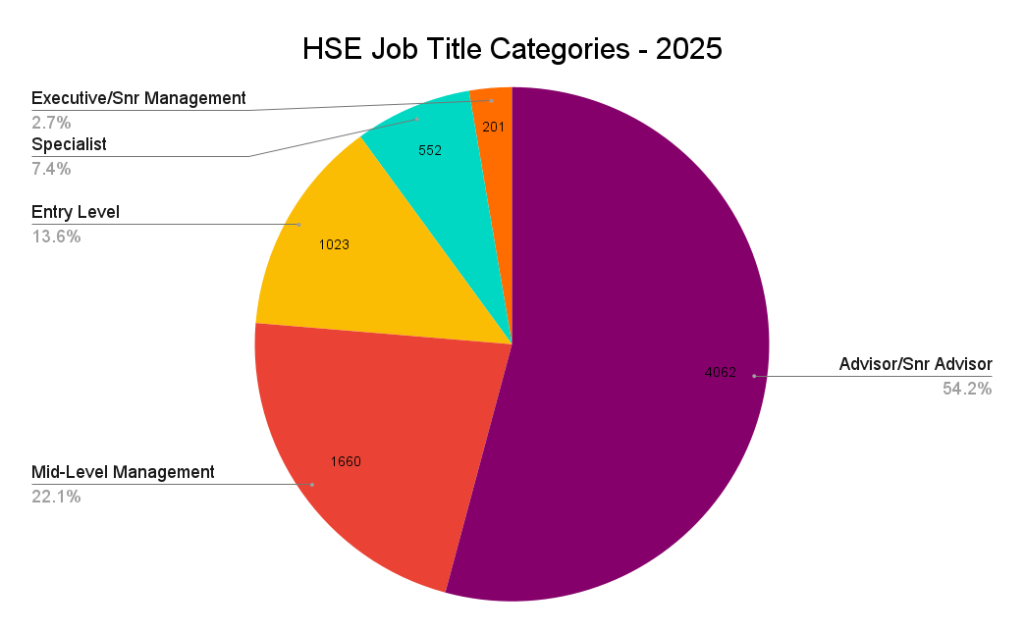

And at What Level?

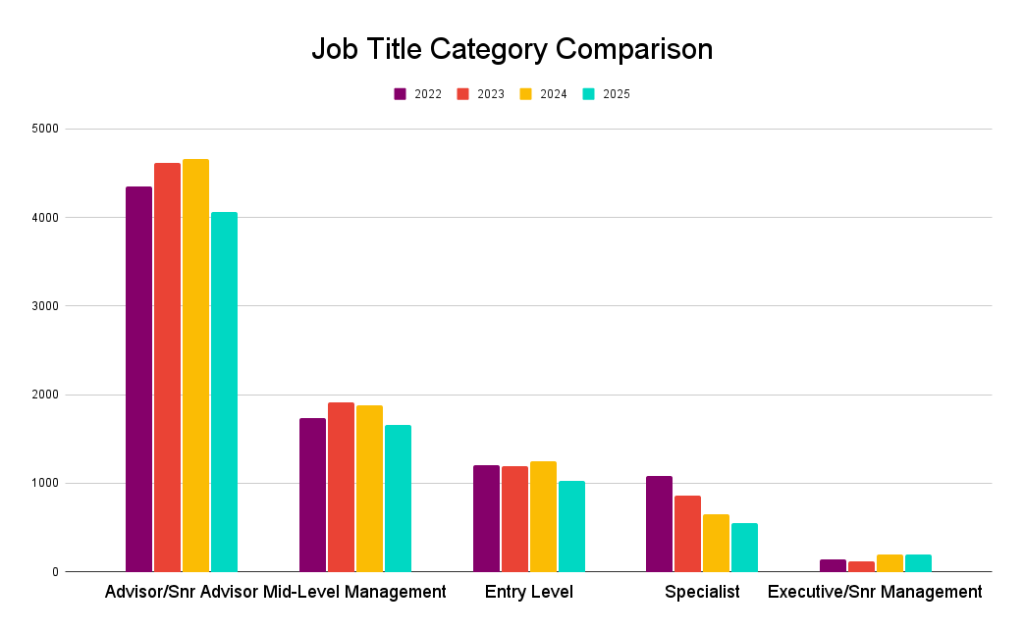

Unsurprisingly, in 2025, the majority of vacancies advertised were allocated to Advisor/Snr Advisor/Business Partner/Consultant level (54% of vacancies).

Following behind were vacancies targeting mid-level managers (22%) and Entry Level professionals (14%).

Specialist roles (e.g. workers’ compensation, injury management, systems, etc.) were steady for their market portion.

Compared to 2024, Advisor/Snr Advisor/Business Partner/Consultant dropped by -13%.

Mid-level Management vacancies dropped by -11%, and Specialist roles dropped by -15%.

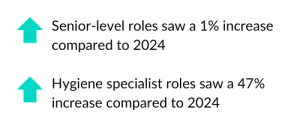

Executive/Snr Management roles grew by 1%.

Compared to 2023, there were decreases for all job titles except for Executive/Snr Management roles, which increased by 73%.

- Advisor/Snr Advisor roles dropped by -12%

- Mid-Level Management dropped by -13%

- Entry-Level dropped by -15%

- *Executive/Snr Management rose by 73%

*As the chart depicts, executive/snr management roles make up the smallest representation. There was a steady number of executive / snr management roles advertised, except in July and December. The State advertising the most executive opportunities across the year was NSW.

Construction Continues to Dominate

Just like in 2022, 2023 and 2024, construction continued to dominate as the number one employer of health and safety professionals across most States in 2025, except WA, where mining led and TAS, where Government led.

The breakdown went like this;

Among the top 14 industries we categorise, the only increase compared to 2024 was in Utilities (1%).

Compared to 2023, all 14 industries saw decreases.

What Can We Expect in 2026?

Based on recent reports from Deloitte Access Economics, the job market outlook for 2026 overall is described as a transition from a “flat patch” to a period of renewed, though moderate, momentum.

And PwC’s 29th Global CEO Survey revealed that Australia’s CEOs are more optimistic about the nation’s economic outlook in the next 12 months (58% up from 35% last year), and confident in revenue growth (49% up slightly from 47% last year).

We are optimistic also that the HSE profession will continue to offer great opportunities for great people, particularly within the construction / infrastructure, renewables and human services industries – all of which appear stable and poised for continued growth, but keep these things in mind;

- Following the trends we observed in 2025, organisations are expected to intensify their adoption of AI tools to enhance efficiencies within Health, Safety, and Environment (HSE). Consequently, it will become more common for AI experience to be explicitly sought in job advertisements, Position Descriptions and, of course, Resumes.

- Navigating the job market as a candidate and as a hiring manager can feel frustrating, with many companies adopting AI tools to screen applicants and many AI tools building resumes that often inflate candidates’ experience.

- Psychosocial risks are continuing to dominate agendas, and we predict that some businesses will still be dithering as to whether the responsibility of legislatively aligned wellbeing strategies and programs is the responsibility of P&C or HSE.

- Sustainability, Enterprise Risk Management and Safety remain interconnected, and we predict that we’ll continue to see the roles of HSE leaders evolve to lead all three of these key business imperatives.

Commercial Acumen, Influence, Stakeholder engagement, and the ability to consider multiple perspectives are the four common personal traits we are often asked to test when recruiting HSE professionals. Although AI is emerging quickly, it can’t replace these human traits.

Disclaimer

Please note that, compared to other health and safety recruitment data sources, HOK does not report on the healthcare / aged-care ‘safety’ roles not in the HSE job family (e.g. Patient Safety, Clinical Safety, Radiation Safety etc that other reports will classify) and based on the data from ABS, SEEK, etc, our data is in line with the market.

Final Word

We’re really excited to see what 2026 holds and will continue to report regularly. And, we’re here to support you with your job search or to recruit great HSE talent into your leadership team.

No Comments